The Truth About Customs Audits: 5 tips to avoid red flags with the CBSA

The truth is that Customs knows everything already. If they have shown up at your premises and requested access to your records, it is already too late. Canada Customs has access to trade data from every vendor in the world–they know what your competitors pay for the same products you buy, and therefore can easily detect any attempts at undervaluation.

“Undervaluation” is one of many schemes an importer can use to lower the amount of tax and duty required to be collected on their imports. With a little bit of winking to a vendor, the stated price for the product they are buying can be lowered on the customs invoice so that the duty and tax amount reduces as well. This practice is a real sore spot with Customs. Importers should know that pleading ignorant will not wash as it is the importer of record’s responsibility to verify the accuracy of their declarations.

What does Customs do when they uncover such a practice?

Penalties and the potential withdrawal of importing privileges can be used by Customs to ensure good faith amongst its stakeholders. For cases where importers have dodged duties and taxes, these amounts also must be repaid along with interest.

This article is not meant to scare the average importer or assume they are involved in foul play. If you are at all concerned about your compliance record as a company, you are already ahead of the game. The CBSA is not interested in hurting Canadian business or making them less competitive, and many options exist to reduce your exposure should you find an importing error that has dated back a few years. Please follow these five steps to ensure a healthy compliance record:

1. Keep everything. For six years.

You can throw out those ancient invoices if they are collecting dust in your office–the CBSA is only concerned with the past six years of your importing activity. “Records” could be any of the following:

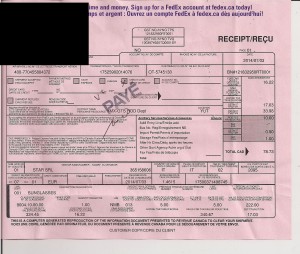

-invoices and receipts for payments to vendors

-Bills of Lading

-B3s

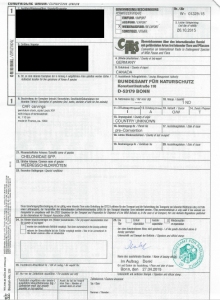

-certificates of origin

-communications to vendors as well as any contracts

The records do not need to be kept in hard copy, but must be organized and in a media format that can be reproduced on paper (any computer file is fine). Customs has the right to search any and all files but it will be in your best interest to make the audit process easy for them.

2. Use a Customs broker

We have had more than one self-clearing client who assumed that because a BSO (Border Services Officer) was releasing their entries, that their declarations and classifications were being done properly. This turned out not to be the case as we had one importer who had been underpaying duties on their self-cleared entries for years. BSOs are not classification experts and their decisions can be repealed at any time by a higher authority at the CBSA (what Customs calls a “re-determination”). Customs brokers are not perfect and can also file erroneously on your behalf, but they remain your best bet to stay compliant.

3. Double-check your entries

Whether you self-clear or use a broker, double-checking your entries as they are processed is a sure way to stay free from errors. Watch out for changes in classification or prices that do not match what you have paid to your seller.

4. Correct any vendor’s errors

Vendors are vulnerable to errors when invoicing you, and may even reduce the value on your purchases to save themselves additional costs on shipping and insurance. Even though it was your vendor’s fault, you as the importer will be held responsible by Canada Customs.

5. File claims

If you do notice an error, have your broker file a claim to correct the problem. This does not need to be the same broker that filed your original entry. A claim is filed on Form B2 and is presented by your broker to the Customs office for review where it is typically approved in 90 days or less. A B2 has the effect of changing the recorded status of the original entry wherever there is a mistake–whether revenue is owed or not.

As a final word, not all audits are bad. In many cases, you may be overpaying on your customs entries and be due a refund from the CBSA. However, it is not the policy of the CBSA to investigate cases where revenue is owing or neutral, so let this be motivation to stay vigilant.