What is the TPL?

Tariff Preference Level: A specific exception under NAFTA relating to garments (and some other commodities) that use fabric from foreign sources. This covers most clothing for any vendors that are only involved in the cutting and sewing of their clothing production.

Why does this concern me?

If you are involved in the importation of clothing made within the USA or Mexico, an extra document will be needed in order to avoid paying duty.

Are all American-made clothes subject to TPL?

No, only goods that are made from fabric sourced outside the NAFTA zone. Certain fabrics, such as linen and silk, are also exempt regardless of where the fabric originates.

How do I know if the goods I am buying qualify for TPL?

You don’t– but your seller does. Make sure before placing any orders that your seller understands their TPL eligibility as a producer and can supply an Exporter’s Certificate of Non-Originating Textile Goods.

What is required to apply for a TPL permit?

Your customs broker will need a copy of your commercial invoice and the Exporter’s Certificate of Non-Originating Textile Goods to obtain your TPL permit.

Are the permits free?

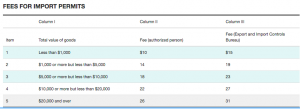

No, they range in price based on the value of the order. Please find a schedule below:

Can I apply for TPL permits anytime?

Yes, although the permits are subject to a first-come, first-serve quota that typically fills up halfway through the year.

I imported goods that qualify for TPL, but did not obtain the permit at time of import and I am stuck paying the duty. Is there any way out?

Yes, if you have the Exporter’s Certification, you may still obtain the permit and file a claim to obtain the duty back. However, if the quota for the year in which the goods were imported is full then the permit will not be issued meaning it will be too late for the refund.