Part two in our series of import guides on specific commodities: the rag trade or schmatta business.

Garments are one of the most popular items imported into Canada–and one of the most protected–with duty rates averaging 17.5% and legislation (particularly for NAFTA-sourced goods) reaching epic levels. That said, no specific permits are required to import textiles or garments. Assuming you have already found a vendor overseas, please follow the below check list to assure a smooth importing process.

| Importing difficulty | Easy |

| Classification Header | Chapters 61 or 62 |

| Duty rate | 17-18% |

| Tax rate | 5% |

| Additional Requirements | Textile Labelling and Advertising Regulations (post-import) |

| Shipping method | Ocean or air freight |

| Sources | Anywhere |

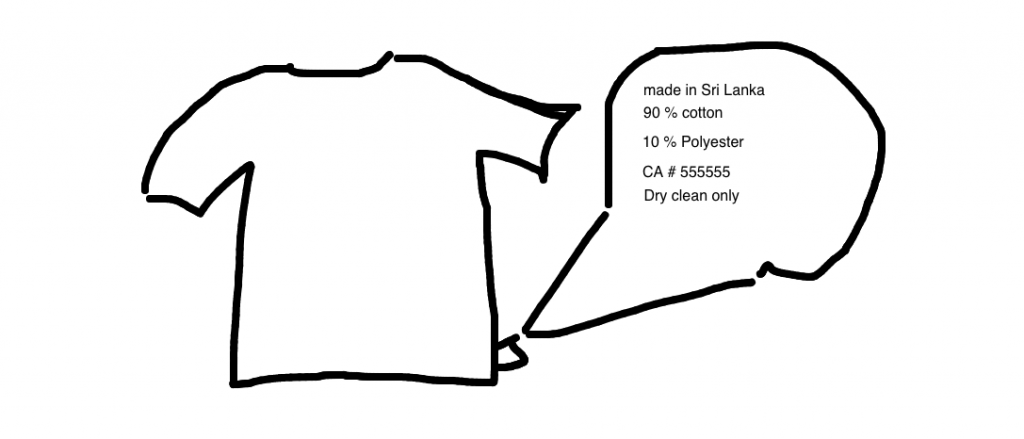

- Vendor communication: ensure the goods are marked with the country of manufacture in advance of shipping (this can be on the label). If the garments or textiles arrive without labelling, you could face penalties as well as the requirement to label all of the articles before they are released.

- Duty reduction: are the clothes made in Europe, the NAFTA zone or a GPT nation? Ask your vendor if the goods qualify for duty-reduction and ensure they provide the correct certification to take advantage of the lower duty rate.

- Shipping and customs: Is your seller handling shipping for you? If not, please contact Border Bee for any freight orders you need help shipping.

- Pay the duty: as mentioned, duty on garments is steep and there is little you can do about it. Even garments made in the USA and Europe must meet additional requirements for duty-free entry.

That’s it! When the clothes arrive in Canada, your customs broker will pay the duties and release the package. In the case of small parcels, the goods will bed delivered once the items are released. For freight, your broker may need to arrange the local delivery.

More questions? Need help shipping or importing your orders? contact us